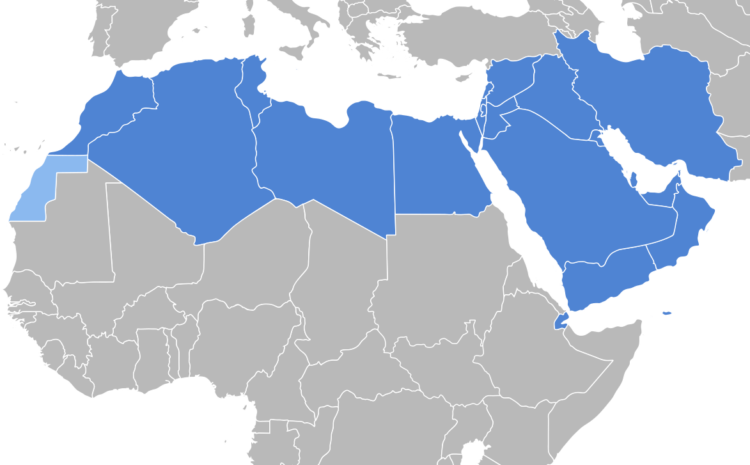

Middle East and North Africa region is considered a strategic region because of its natural resources and its position as center point of the world. Today MENA region is one of the world’s fastest growing economies, it has been attracting investors with the discovery of petrol particularly in the Gulf region and states like Egypt, Jordan, Iraq and lately Lebanon.

Traditionally the economic focus was on the petroleum industry. However states in the MENA region are tending toward new strategies and sectors to serve as a focal point for economic growth. This new vision was presented through a variety of new projects introduced by some of the Gulf States like: Saudi Arabia vision 2030, Kuwait vision 2035, the 2022 Qatar World Cup, and United Arab Emirates vision 2030, where these counties plan to promote their status into premium financial and commercial states.

The big interest from investors and particularly the foreign ones, led to growth in the legal market in this region. One of the main characteristics of the legal market in the said region is the existence of international law firms in addition to the national ones.

In our study we will study the legal market in the MENA region, by focusing on some states as samples.

- Saudi Arabia:

When global oil prices collapsed in summer 2014, Saudi Arabia confronted one of the most daunting economic challenges of its modern history. Upon ascending to the throne the following year, King Salman bin Abdul-Aziz Al Saud and his son Mohammed bin Salman Al Saud (now the crown prince) responded by developing an ambitious economic and social reform plan, Saudi Vision 2030, which was unveiled in 2016 and designed to reduce the country’s dependence on oil by facilitating the emergence of a robust private sector.

Saudi Arabia GDP at Current Prices in 2021 was estimated about 2.5 (SAR Billion), the value of foreign investments in 2021 was 19.29 Billion US Dollars.

The main method of resolving commercial disputes in Saudi Arabia is litigation. Arbitration is also becoming increasingly popular as a result of the Arbitration Regulation of 2012, which is based on the UNCITRAL model.

The main practice areas of law firms in Saudi Arabia are: Corporate, Construction (value of construction sector in the Saudi’s GPD was estimated about 133.326 SAR Billion ), Litigation, and Energy Law (value of Oil Exports in 2021 was 758 SAR Billion that equals 201 billion US $ ).

- United Arab Emirates:

Today, the UAE has transitioned again into a diversely productive economy that is based on internationally-emerging knowledge and future energy. Furthermore, the UAE’s population has transitioned from poverty to one of the highest income levels in the world.

Considering the UAE is a major trading hub and a host country for foreign investment, arbitration is becoming an optimal method, for parties to solve their commercial disputes.

The official estimate for United Arab Emirates GDP was 640 Billion US $at the end of 2021, the value of foreign investments in UAE in 2021 was171.6 Billion US $.

ADR methods are preferred by the investors to settle down their disputed and especially their commercial disputes.

According to the annual report of 2020 issued by Dubai Chamber of Commerce, Dubai International Arbitration Center has handled till 2020: 3,376 arbitration case. Also according the annual report of2021, Dubai Chamber’s legal services department has settled by mediation 5 million case with a value reached AED 5 million.

These numbers and statistics reflect investors’ preference to recourse to ADR in their commercial disputes.

The main practice areas of law firms in UAE are: Construction arbitration ( Dubai’s real estate market recorded 84,772 transactions valued at AED 300 billion \$81.6 billion\ in 2021 ), front-end construction, debt capital markets, TMT, project finance, Corporate, and Energy law sector ( value of petroleum exports in 2021 was (Million $) 54,595).

- Qatar:

Qatar remains one of the most prosperous nations in the Middle East, mostly off the back of its colossal export of oil and gas (particularly liquid natural gas), also having the third largest reserves in the world. Its natural resources accounted for 60% of its GDP last year. The country has invested a sizeable amount into developing key construction projects, developments and entertainment facilities in the run-up to the highly anticipated 2022 FiFa World Cup.

Qatar’s GDP at Current Prices in Third Quarter 2021 was estimated about 176.225 Billion QR, the value of foreign investments in 2021 was 35 Billion US Dollars.

Litigation and Arbitration are considered the main means to settle disputes. For investors and mainly the foreign ones prefer to recourse to arbitration to settle their commercial disputes.

It was stated that “Foreign investors often select arbitration as the method of dispute resolution, either in institutions inside Qatar like Qatar International Center for Conciliation and Arbitration (QICCA) or institutions outside Qatar like International Chamber of Commerce ICC or London Court for International Arbitration LCIA.

Parties did not commonly recourse to Mediation as a form of dispute resolution in Qatar, for fear of significant time and cost being invested without the existence of effective legal frame work to enforce it. However today Qatar is tending towards Mediation as a preferable way to resolve disputes by ratifying the Singapore Convention on Mediation as well as issuing the Mediation Law.

The main practice areas of law firms in Qatar are: Commercial and Corporate law, Energy sector ( 34,021 million QR value of petroleum exports in June 2022 ),Real estate and Construction (Value of sold properties in Qatar in June 2022 reached 2,836.2 million QR ), Sports law especially after Qatar won in 2010 the bid to host the 2020 Fifa World Cup.

- Turkey:

Turkey is still defined as an emerging market economy; over the last 20 years, it established itself increasingly among the top-25 global markets, but could not maintain this upward trend in recent times. Recently, it has had to face a currency crisis due to the Turkish lira decreasing dramatically in value.

The Gross Domestic Product (GDP) in Turkey was worth 815.27billionUS Dollars in 2021, according to official data from the World Bank, the value of foreign investments in Turkey in 2021 was 14.2BillionUSDollars.

The main dispute resolution methods in Turkey are litigation and arbitration, recently mediation is becoming a preferable way in resolving disputes.

The legal market is dominated by internationally-affiliated firms, having a notable presence across major practice areas, as well as Key domestic firms handling both contentious and non-contentious work across a variety of sectors, while a number of smaller often boutique firms handle specific areas such as IP, dispute resolution, competition and insurance work for domestic and international clients. Recently The IT and technology sectors has been the source of the most interesting transactional matters in the Turkish legal market and are keeping firms on their toes as regards regulatory issues too.

- Egypt:

In spite of the challenges of the Covid-19 crisis, Egypt has proved a resilient economy in 2021, fueled by the country’s plenty macroeconomic reforms. President Abdel Fattah al-Sisi’s announcement of the end of the state of emergency, in place since 2017, speaks of increased stability. Firms also report businesses operating at full capacity again after a big slowdown in activity at the start of the pandemic. The New Administrative Capital being built close to Cairo is symptomatic of the country’s building boom when it comes to the development of new cities, including mega-project New Alamein.

The Gross Domestic Product (GDP) in Egypt was worth 404.14 billion US Dollars in 2021, according to official data from the World Bank, the value of the foreign investments in 2021 was 5.12 Billion US Dollars.

The main methods to settle disputes in Egypt are litigation and arbitration, in large commercial disputes arbitration is becoming a preferable mean to settle them.

The main area of practice of law firms are: Construction sector, Energy law, Petrochemical sector, commercial, corporate, as well as banking and finance.

Finally, with the great development that the MENA region is witnessing in business and finance the legal market is expanding more and more especially with the great interest of international law firms to have presence in the region. Investors prefer this region because of its richness in petrol and other natural resources. With more investments taking place the legal market is expected to evolve even further.

List of references:

- DaniyalAziz, The Legal Market in Saudi Arabia, Inter Link, https://www.interlinkrecruitment.com/blog/legal-market-saudi-arabia

- Ministry of Economy and Planning, Annual Indicators, https://www.mep.gov.sa/en/Pages/AnnualIndicators.aspx

- https://www.alarabiya.net/aswaq/special-stories/2022/03/29/%D8%A7%D9%84%D8%A7%D8%B3%D8%AA%D8%AB%D9%85%D8%A7%D8%B1-%D8%A7%D9%84%D8%A3%D8%AC%D9%86%D8%A8%D9%8A-%D8%A7%D9%84%D9%85%D8%A8%D8%A7%D8%B4%D8%B1-%D8%A8%D8%A7%D9%84%D8%B3%D8%B9%D9%88%D8%AF%D9%8A%D8%A9-%D9%8A%D9%82%D9%81%D8%B2-%D9%84%D9%8019-3-%D9%85%D9%84%D9%8A%D8%A7%D8%B1-%D8%AF%D9%88%D9%84%D8%A7%D8%B1-%D9%81%D9%8A-2021

- Saudi Arabia: Litigation, The Legal 500, https://www.legal500.com/guides/chapter/saudi-arabia-litigation/

- MhammadNour, Al Watan Newspaper, https://www.alwatan.com.sa/article/1095788

- Ministry of Economy and Planning, Annual Indicators, https://www.mep.gov.sa/en/Pages/AnnualIndicators.aspxJameson Legal’s Middle East Practice, https://www.jamesonlegal.com/global-network/middle-east

- https://www.cpc.gov.ae/en-us/theuae/Pages/AboutUAE.aspx

- https://u.ae/en/information-and-services/justice-safety-and-the-law/litigation-procedures/alternative-methods-to-settle-disputes-

- World Economics , United Arab Emirates’ Gross Domestic Product (GDP), https://www.worldeconomics.com/Country-Size/United%20Arab%20Emirates.aspx

- Ministry of Economy, UAE, https://www.moec.gov.ae/en/foreign-investment-inflow

- Dubai Chamber of Commerce annual report 2020, https://www.dubaichamber.com/annualreport/2020/annual_report_2020_english.pdf

- Dubai Chamber of Commerce, annual report 2021, https://www.dubaichamber.com/annualreport/

- https://www.dubaichamber.com/annualreport/assets/downloads/annual_report_2021_english.pdf

- Legal overview in United Arab Emirates, The Legal 500, https://www.legal500.com/c/united-arab-emirates/legal-market-overview/

- https://www.opec.org/opec_web/en/about_us/170.htm

- Legal Market Overview: Qatar, The Legal 500, https://www.legal500.com/c/qatar/legal-market-overview/

- Planning and Statistics Authority, https://www.psa.gov.qa/en/statistics1/pages/default.aspx

- https://m.al-sharq.com/article/07/05/2022/35-%D9%85%D9%84%D9%8A%D8%A7%D8%B1-%D8%AF%D9%88%D9%84%D8%A7%D8%B1-%D8%A7%D8%B3%D8%AA%D8%AB%D9%85%D8%A7%D8%B1%D8%A7%D8%AA-%D8%A3%D8%AC%D9%86%D8%A8%D9%8A%D8%A9-%D9%85%D8%A8%D8%A7%D8%B4%D8%B1%D8%A9-%D9%81%D9%8A-%D9%82%D8%B7%D8%B1#:~:text=%D8%AA%D9%85%D9%83%D9%86%D8%AA%20%D8%AF%D9%88%D9%84%D8%A9%20%D9%82%D8%B7%D8%B1%20%D9%85%D9%86%20%D8%A7%D8%B3%D8%AA%D9%82%D8%B7%D8%A7%D8%A8,%D8%B1%D8%A3%D8%B3%20%D8%A7%D9%84%D9%85%D8%A7%D9%84%20%D8%A7%D9%84%D8%A3%D8%AC%D9%86%D8%A8%D9%8A%20%D9%81%D9%8A%20%D8%BA%D8%A7%D9%84%D8%A8%D9%8A%D8%A9

- Doing Business in Qatar, SQUIRE PATTON BOGGS, https://www.squirepattonboggs.com/-/media/files/insights/publications/2019/06/doing-business-in-qatar/doing-business-in-qatar.pdf

- QATAR MONTHLY STATISTICS, Statistics of June 2022, https://www.psa.gov.qa/en/statistics/Statistical%20Releases/General/QMS/QMS_PSA_102_Jul_2022.pdf

- QATAR MONTHLY STATISTICS, Statistics of June 2022,

- Christina Detch, Legal Business UK , https://www.legalbusiness.co.uk/countries/turkey-focus-chronology-of-a-crisis/

- Trading Economics, Turkey GDP, https://tradingeconomics.com/turkey/gdp#:~:text=GDP%20in%20Turkey%20is%20expected,according%20to%20our%20econometric%20models.

- https://www.aa.com.tr/ar/%D8%A7%D9%82%D8%AA%D8%B5%D8%A7%D8%AF/%D8%AA%D8%B1%D9%83%D9%8A%D8%A7-%D8%AA%D8%AF%D9%81%D9%82-%D8%A7%D9%84%D8%A7%D8%B3%D8%AA%D8%AB%D9%85%D8%A7%D8%B1-%D8%A7%D9%84%D8%A3%D8%AC%D9%86%D8%A8%D9%8A-%D8%A7%D9%84%D9%85%D8%A8%D8%A7%D8%B4%D8%B1-%D9%8A%D8%AD%D9%82%D9%82-%D8%B1%D9%82%D9%85%D8%A7-%D9%82%D9%8A%D8%A7%D8%B3%D9%8A%D8%A7-%D9%81%D9%8A-2021-%D8%AA%D9%82%D8%B1%D9%8A%D8%B1/2510333#:~:text=%D8%AD%D9%82%D9%82%D8%AA%20%D8%A7%D9%84%D8%A7%D8%B3%D8%AA%D8%AB%D9%85%D8%A7%D8%B1%D8%A7%D8%AA%20%D8%A7%D9%84%D8%A3%D8%AC%D9%86%D8%A8%D9%8A%D8%A9%20%D8%A7%D9%84%D9%85%D8%A8%D8%A7%D8%B4%D8%B1%D8%A9%20%D9%81%D9%8A,%D9%82%D9%8A%D9%85%D8%AA%D9%87%D8%A7%2014%2C2%20%D9%85%D9%84%D9%8A%D8%A7%D8%B1%20%D8%AF%D9%88%D9%84%D8%A7%D8%B1.

- Legal market overview in Turkey, The Legal 500, https://www.legal500.com/c/turkey/legal-market-overview/

- Legal market overview in Egypt, The Legal 500, https://www.legal500.com/c/egypt/legal-market-overview/

- Trading Economics, Egypt GDP, https://tradingeconomics.com/egypt/gdp

- https://enterprise.press/ar/stories/2022/06/15/%D8%AA%D8%AF%D9%81%D9%82%D8%A7%D8%AA-%D8%A7%D9%84%D8%A7%D8%B3%D8%AA%D8%AB%D9%85%D8%A7%D8%B1-%D8%A7%D9%84%D8%A3%D8%AC%D9%86%D8%A8%D9%8A-%D9%84%D9%85%D8%B5%D8%B1-%D8%AA%D8%AA%D8%B1%D8%A7%D8%AC%D8%B9/

- Legal market overview in Egypt, The Legal 500, https://www.legal500.com/c/egypt/legal-market-overview/